In the world of business, there are moments when the accounting stars align perfectly. And then there are those other times when a receipt goes missing, or a purchase is so hasty that the original receipt doesn't make it into your files. When the latter happens, what's a conscientious business owner or employee to do? The answer is simple: create your own receipt. We're here to make it easy for you with a free, professional, and user-friendly self-receipt template available for download at Consultinghouse.

The Importance of a Self-Receipt

Every company, no matter its size or industry, has had that moment when a receipt is nowhere to be found. It's a common occurrence in the world of accounting, and it can be a real headache. The fundamental principle of "no booking without a receipt" is something auditors and tax authorities take very seriously. However, you can save yourself the stress and hassle by using your own self-receipt.

By utilizing a self-receipt, you can effectively replace the missing or damaged original receipt, ensuring your accounting remains accurate and complete. Consultinghouse is here to assist you with this essential tool, offering a clear and comprehensive personal receipt template entirely free of charge.

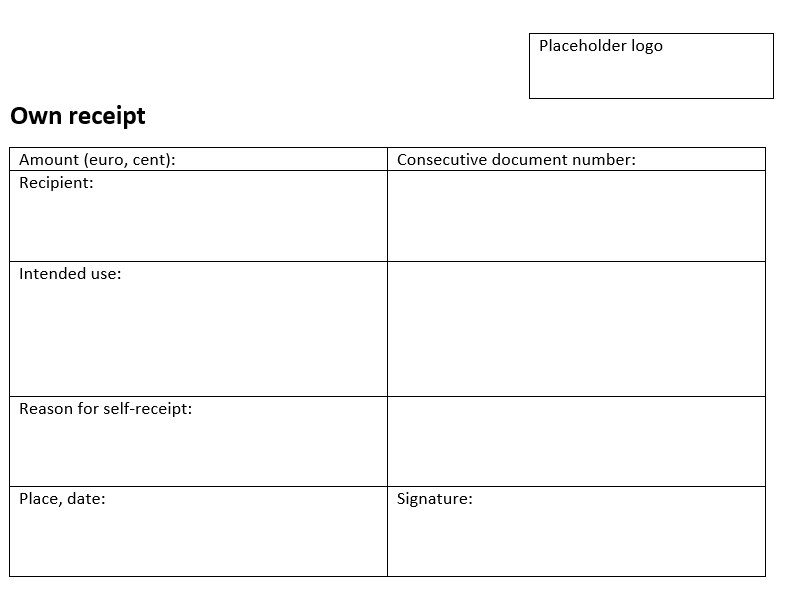

How to Properly Fill Out Your Self-Receipt Template

Creating your own receipt is a valuable skill, but it's essential to use it judiciously. Overusing self-receipts may raise red flags with auditors and tax authorities. Therefore, it's crucial to ensure that the information you include is accurate and complete, just like an original receipt.

Here's a quick rundown of the key information your self-receipt should include:

- Name and Address of the Payee: Make sure to specify the recipient's name and address.

- Type of Expense & Date: Describe the nature of the expense and provide the date.

- Invoice Amount: Clearly state the total amount spent.

- Reason for Creating the Self-Receipt: Explain why you had to create your own receipt, whether it's due to a missing or unreadable original receipt.

- Signature of the Payer: A valid self-receipt requires your signature for authenticity.

For those who prefer a more straightforward approach, Consultinghouse provides a user-friendly Word template that allows you to create a professional self-receipt in under a minute. Simply download the template, insert your logo and data, and follow the steps mentioned above.

Creating Your Own Receipt - Step by Step

Creating your own receipt is a straightforward process, and Consultinghouse is here to guide you through it. Here are the steps:

- Download Your Free Receipt Template: Begin by downloading our self-receipt template at no cost.

- Enter Receipt Details: Fill in your receipt number, invoice amount, and the name of the payee.

- Specify the Reason: Describe why you're creating your own receipt, such as an unreadable or lost original receipt.

- Record the Date and Location: Include the date and location of the transaction.

- Add Your Signature: Finally, sign your self-receipt to validate it.

Practical Tip

If you've paid by debit card and can provide a corresponding bank statement, the process becomes even more straightforward. In this case, you only need to submit the bank statement with the necessary information, including the date, signature, and the reason for the missing original receipt.

Archiving Your Self-Receipt

Remember, you are legally obligated to keep your self-receipt for ten years, just like any other financial documents and invoices. To ensure compliance with GoBD (Principles for the Proper Management and Storage of Books, Records, and Documents in Electronic Form as well as for Data Access) requirements, these factors should be met:

- Immutability of Bookings: Your records must remain unaltered.

- Time Requirements for Recording: Ensure timely documentation of all financial transactions.

- Completeness of Records: Keep all relevant documents.

- Traceability of Records: Make sure your records are traceable and linked to the respective transactions.

Consultinghouse is your contact for efficient accounting!

Take your accounting to the next level with Consultinghouse. Our expert accountants will streamline your financial operations and make them effortless. Let's talk about your accounting needs - schedule a free call today.